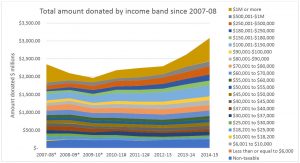

Deductible gifts recorded in individual taxpayer’s returns have broken through $3.1 billion in 2014‑15 (compared to $2.6 billion in the previous year). This constitutes a 15% increase or $464 million from the previous income year.

Where did this growth come from?

It was the income wealthy that made the biggest contribution. Those with a taxable income over $1 million in 2014–15 claimed average tax-deductible donations of $98,324.68 (up from $51,978.72 in previous year). This group now represents 21.1% of all tax-deductible donations being a total of $649.93m. Those in income levels immediately below the million dollar band have also had significant increases in donations. The median (the middle number when all values are aligned in numerical order) for those with over $180,000 taxable income making donations was $550 for females and $421 for males. This indicates that there may have been a few individuals claiming significant gift deductions.

Over 40% of taxpayers with over a million dollars in taxable income did not claim a gift deduction and with slightly more not claiming who had taxable incomes over $250,000.

While the higher income brackets have increased their amount given following the GFC downfall, the lower income brackets have flatlined.

Hang-on Giving Australia didn’t show this increase of giving?

In 2016, the second Giving Australia project was conducted, examining giving and volunteering behaviours from 6,201 adult Australians. An estimated 14.9 million Australian adults (80.8%) donated $11.2 billion to charities and nonprofit organisations (NPOs) over 12 months in 2015–16. The average donation was $764.08 and median donation $200.

Some of the differences are:

- This study goes beyond taxpayers to all Australians and by definition will return a more comprehensive review of giving (not just giving to DGRs) but, because of sampling, lacks the accuracy of the ATO returns where all taxpayers are obliged to file a return and accurately disclose their deductible gifts.

- This study was over a year later than this ATO data, a different time with different economic and fundraising conditions.

Some considerations

If we take the ATO figures at face value can they be reconciled? Some of the possible explanations could be:

- While overall giving may fluctuate, it may be that donors are claiming more of their giving as tax deductions.

- Some of the the drivers for such behaviour may be:

- Tight economic conditions driving donors to seek savings in giving through a tax deduction; and

- Giving through internet portals and workplace giving are rising and these tend to provide a convenient and timely consolidated tax receipt at tax year end prompting more donors to claim previously unclaimed donations.

- The impact of those in the upper income bands may not be caught by other survey methods (e.g. telephone or credit card) and thus not included in the Giving Australia analysis (and other surveys). It is reasonable to assume that a significant amount of the donations from the wealthy are placed in ancillary foundations and yet to be fully distributed to the sector.

- Some of the the drivers for such behaviour may be:

1 Comment

More great work by ACPNS.

21% of all tax deductible donations are coming from the relatively few Australians with incomes over $1m. It is an indication that (many of) those with the greatest capacity to give are indeed giving the most; at least in terms of deductible gifts. Consistent with the Giving Australia findings, the ATO data indicates those who do give are giving more. The 40% of taxpayers with incomes of $1m or more continue, in all probability, to give nothing. Nothing. At least they are in a minority, albeit a hefty one.