Each year Australian taxpayers donate billions of dollars – and each year researchers at ACPNS analyse the ATO gift data. The 2017-18 ATO gift deduction data is now available for analysis. What are the learnings for your organisation’s strategy?

WEBINAR MINI SERIES – RECORDINGS NOW AVAILABLE

Webinar 1 | 29 Sep Gift Deductions https://youtu.be/h3X9-NWb9a0

Webinar 2 | 30 Sep Private Ancillary Funds https://youtu.be/SMx58wHkRgk

Webinar 3 | 1 Oct Public Ancillary Funds https://youtu.be/MYs4TzBAzos

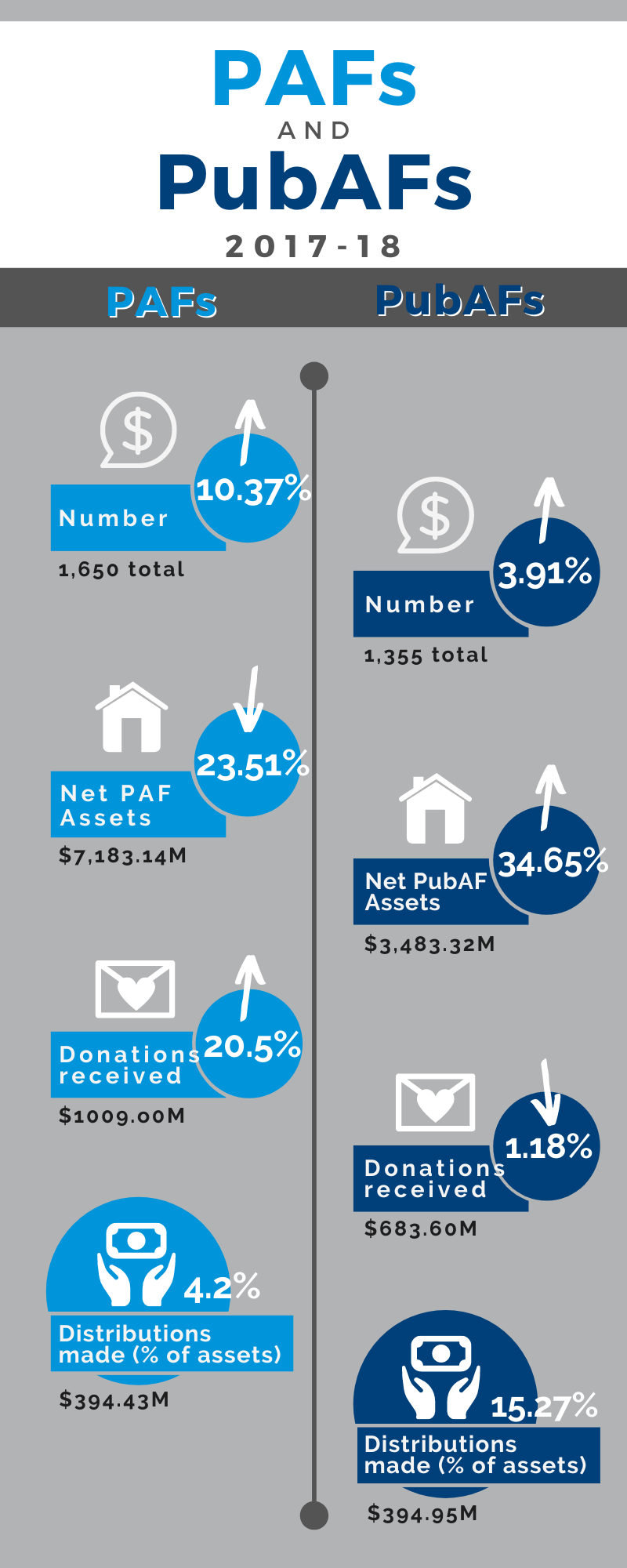

This webinar mini series (each only 25mins long) will give you the short, sharp facts and figures of giving and donating in 2017-18 and examines the learnings for the sector. Based on the most current ATO taxation statistics, sector experts share their insights from the historical data. The first seminar is a general overview of the data by the leaders of Australian peak bodies, together with insights from Prof Patrick Rooney who has led the annual Giving USA data analysis. The second and third seminars examine donations to, distributions from and assets held by Private Ancillary Funds (PAFs) and Public Ancillary Funds (PubAFs).

Access the recordings now to find out how YOU can use the data to advance your nonprofit’s mission.

Access the reports

The giving reports, containing an analysis of tax-deductible giving by postcode, gender, state and occupation, is available online:

Full report: https://eprints.qut.edu.au/204319

Short Information Sheet: https://eprints.qut.edu.au/204544

Ancillary Funds Information Sheet: https://eprints.qut.edu.au/204322

Discover more about the project (including how ‘giving’ your postcode and occupation are), on the ACPNS giving stats page.